AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Month-on-month revenue metrics and retention rate are critical KPIs to look for in startups – Angel Investor Mehul Mishra [Interview Part 1]

[This is Part 1 of AsiaTechDaily’s interview with Mehul Mishra. Click here to read Part 2 of the article]

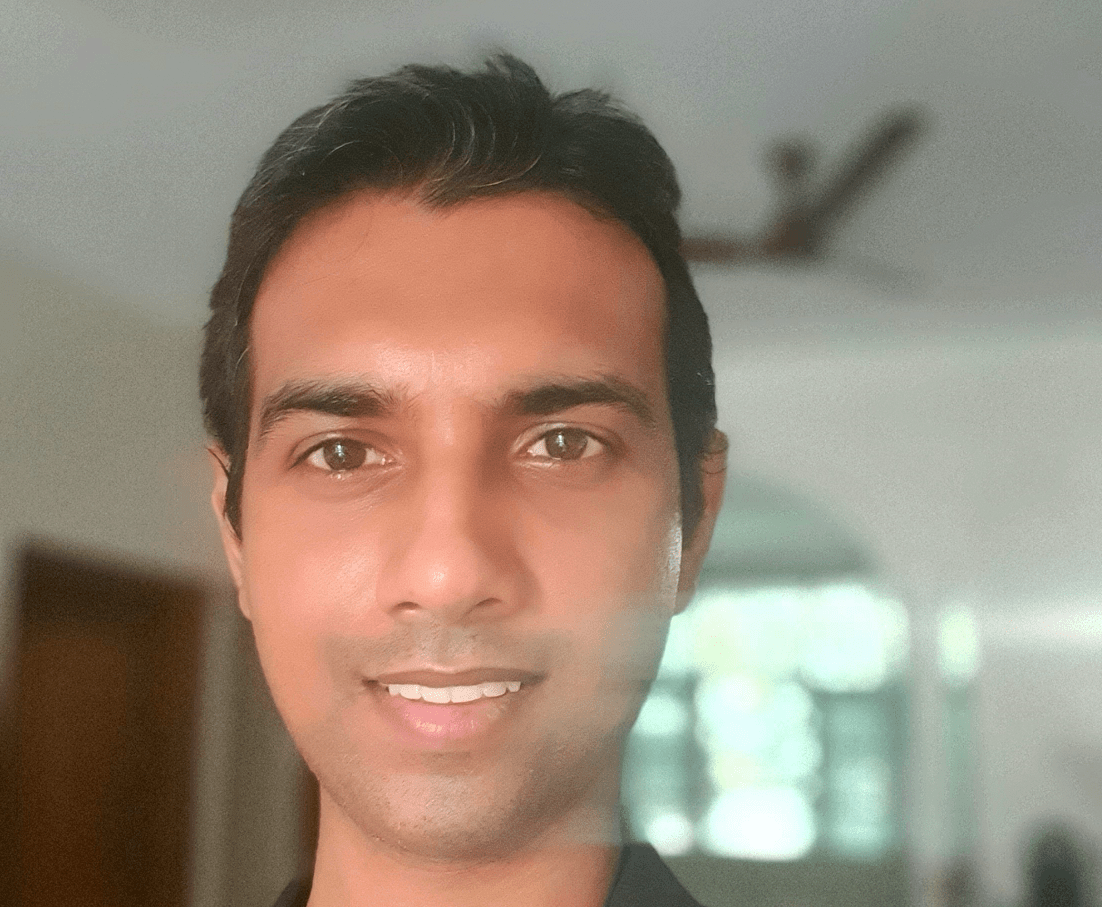

Mehul Mishra is an India-based angel investor who has worked at top-tier management consulting firms Accenture and Kearney in the past. Currently, he works with Brand Capital, the strategic investment arm of The Times Group India, as investment manager. He has invested in over 30+ startups globally since 2014 and was a seed investor in current unicorns Flexport, Weave and Memebox.

He currently runs a syndicate on Angelist and has been mentoring startups in the fields of e-commerce, crypto, Augmented Reality(AR), Virtual Reality(VR) and Artificial Intelligence (AI).

Over the past several years he has been involved in the startup ecosystem and is familiar with the best practices that have helped many of the startup succeed.

He believes that setting up these best practices in the early stage of a startup’s journey are a critical component of success, because changing systems and processes becomes more and more challenging as a business grows in size. Mehul has a B-Tech in Electronics and communication and an MBA from ISB Hyderabad. Mehul answers a few questions for AsiaTechDaily. He says –

Irrespective of where they are headquartered, raising funding from American VCs comes with several advantages including great signaling to recruit top tier talent and access to a large network of associated investors. This compounds the probability of success dramatically and opens doors for further rounds of funding and growth.

All VCs are not the same so founders need to familiarize themselves with the VC’s investment process. A quick and easy way of doing that would be to read articles on the VC’s investment philosophy and their interviews where they specify their criteria.

AsiaTechDaily: Tell us about your professional background and how you got into startup investments?

Mehul Mishra: I started my career in management consulting at Accenture and later joined Kearney. I worked on diverse board level projects ranging from developing a five year strategy for Tata Motors to building out the procurement system for companies like Cipla.

Consulting exposed me to the inner workings of a vast array of industries in a very short period of time, giving me critical perspectives for my future roles in startup investing.At Kearney, I worked on a due diligence project, in which a large Private equity firm was investing in a high growth startup. This became my gateway to startup investing. I began extensively seeking out startups through Angelist and was one of the first Indian investors on the platform at the time. Over time, I was able to leverage that and other similar platforms into a large portfolio of startups.

I went on to do my MBA from ISB where I looked after both the student public markets fund and the angel investment fund. These moves were critical in my shift to startup investing. Since then, I have been working as an investment manager at Brand capital which is India’s largest VC fund. Parallel to these roles, I have been investing in Silicon Valley startups since 2014 with over 30 investments over the past 6 years.

When did you first think about starting a fund?

Mehul Mishra: About four to five years after I started angel investing through personal funds, 3 of the startups that I backed at seed stage became Unicorns – Weave, Flexport and Memebox. Several of the other investors that I had worked with encouraged me to start a fund, which I eventually did. I started a syndicate fund on Angelist that now has hundreds of limited partners.

What kind of startups/sectors have you invested in till now?

Mehul Mishra: I am sector agnostic. I have invested in startups ranging from e-commerce and logistics to SaaS and Augmented Reality. The industry itself is not as important as the size of the industry and the competitive landscape. Most of the current unicorns such as Airbnb and Palantir came from industries where there was virtually no similar competitor but an extremely large market. I have found that if you restricted yourself to certain industries, you would have missed out on several such companies.

Furthermore, some of the biggest companies are monopolies in their respective market. Companies such as Google and Facebook were able to greatly benefit from an early mover advantage in a new industry and went on to create a sustainable monopoly.

What do you look for in a startup before investing? What’s your mental model for investing?

Mehul Mishra: The four most important factors in startup investing are traction, product, team, and market size in that order. The later in terms of stage a company is, the more relevant traction and product become and less important the team. I prefer to look for companies with at least 1.5 – 2 years of revenue that have been growing well (15%+ month on month).

In terms of product, I try to find products that are significantly better than the competition or better still, have yet no competition. If a company is only 10% better than the current competition then it becomes extremely challenging to succeed. The real game-changers come in with products/services that are in order of magnitude better.

What is your typical investment range and how many startups do you invest in per year in general? Additionally, can startups headquartered anywhere get funding from you?

Mehul Mishra: I generally do around 10 deals a year and my syndicate can deploy 100k USD to 500K USD per company. Most of the startups that I have funded have had some presence in the US. That being said many startups were not necessarily headquartered in the US but have had some presence there or raised funds from American VCs. This is something that I recommend all startups do. Irrespective of where they are headquartered, raising funding from American VCs comes with several advantages including great signaling to recruit top tier talent and access to a large network of associated investors. This compounds the probability of success dramatically and opens doors for further rounds of funding and growth.

What would be the KPIs that you usually check about the startups’ growth?

Mehul Mishra: The most important would be month-on-month revenue metrics. It does not matter how good the product/service is unless enough people are willing to pay for it over the long run. Retention rate is another critical component in startup investing as it is a very clear indicator of the quality of product/service. Depending on the industry it is 5 to 25 times cheaper to retain an existing customer than to acquire a new one.

The cost of customer acquisition varies widely by industry and works well only for B2C startups. Since half the companies that I evaluate are B2B, the metrics don’t translate in a meaningful way.

How did you handle the COVID-19 outbreak situation for your fund?

Mehul Mishra: During the beginning of the pandemic, investors were in a wait and watch mode and several companies had trouble raising funds from investors and similarly investors from limited partners. But now things have improved a lot and there has been a renewed interest in VC and startups, that being said, the industry focus has shifted to sectors that benefit from the pandemic such as e-commerce, home entertainment, health and wellness, and online education.