AsiaTechDaily – Asia's Leading Tech and Startup Media Platform

Indian SME Lending Firm: Ziploan

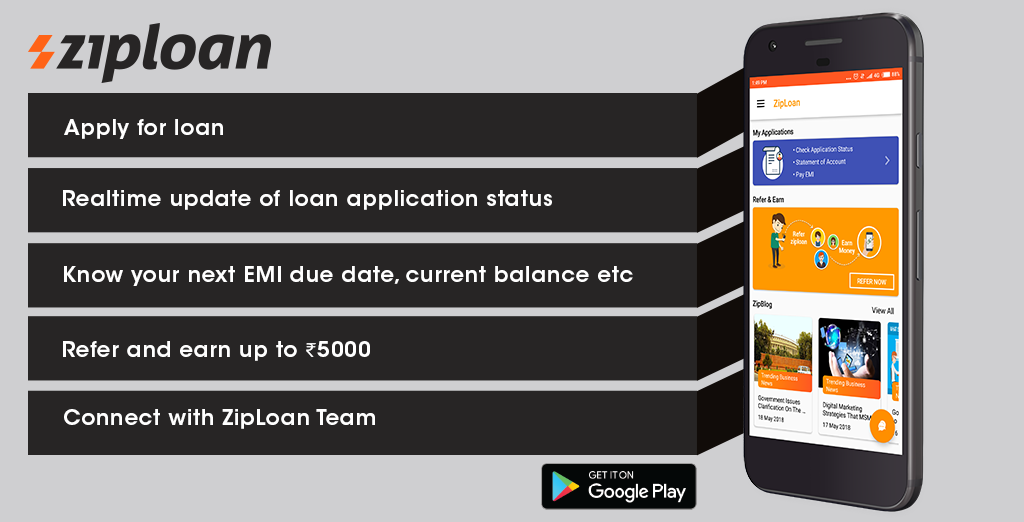

Ziploan is a digital lender that came into existence in the year 2015. It provides micro-enterprises and SMEs with small ticket business loans of up to Rs 5 lakh. Presently, the company has co-lending and debt partnerships with major banks and NBFCs such as IndusInd Bank, IDFC First Bank, Northern Arc, Caspian Finance, MAS Finance, and many more. These associations allow Ziploan to build an inordinately profitable and capital efficient business at scale. Furthermore, Ziploan is presently operative in Mumbai, Lucknow, Indore, Jaipur, NCR, and Dehradun.

SME Lending Firm, Ziploan, declared that it had raised Rs 90 Crore in its Series B financing round conducted by SAIF Partners along with existing investors, Whiteboard Capital, Waterbridge Ventures, and Matrix Partners India also partaking in the round. With this round of funding, the company has managed to raise total equity and debt funding of Rs 320 Crore so far. In addition to that, the company further plans to mobilize Rs 250 Crore from debt investors in order to facilitate growth.

Ziploan Mission

Ziploan aims and strives to be the harbinger of the small business lending revolution. With their focus on granular behaviors of various businesses, the company has scaled up by ten times in the last twelve months. Moreover, Ziploan has paid out Rs 150 Crore with a quality loan portfolio. Ziploan is able to reduce operation cost with the assistance of its proprietary risk assessment engine known as ZipScore. According to Ziploan, small business owners are the real change-makers in our country.

Additionally, Ziploan can create a significant impact on society by gaining access to organized finance. To serve this segment at scale, Ziploan has come up with proprietary technology and machine learning powered applications as well. Lastly, investors such as Matrix Partners, Waterbridge, and SAIF Partners have been helping Ziploan achieve their vision for quite some time now.

The Road Map

The primary goal of Ziploan is to make small business lending hassle-free and efficacious. Ziploan has given a highly remarkable demonstration of effective growth, capital efficiency, and strong book quality.

Last but not least, the company will continue to scale and implement its vision of being the prime lending choice for micro SMEs.

Get in touch with the team today.

Image Source- Google